François Christen

Chief Economist

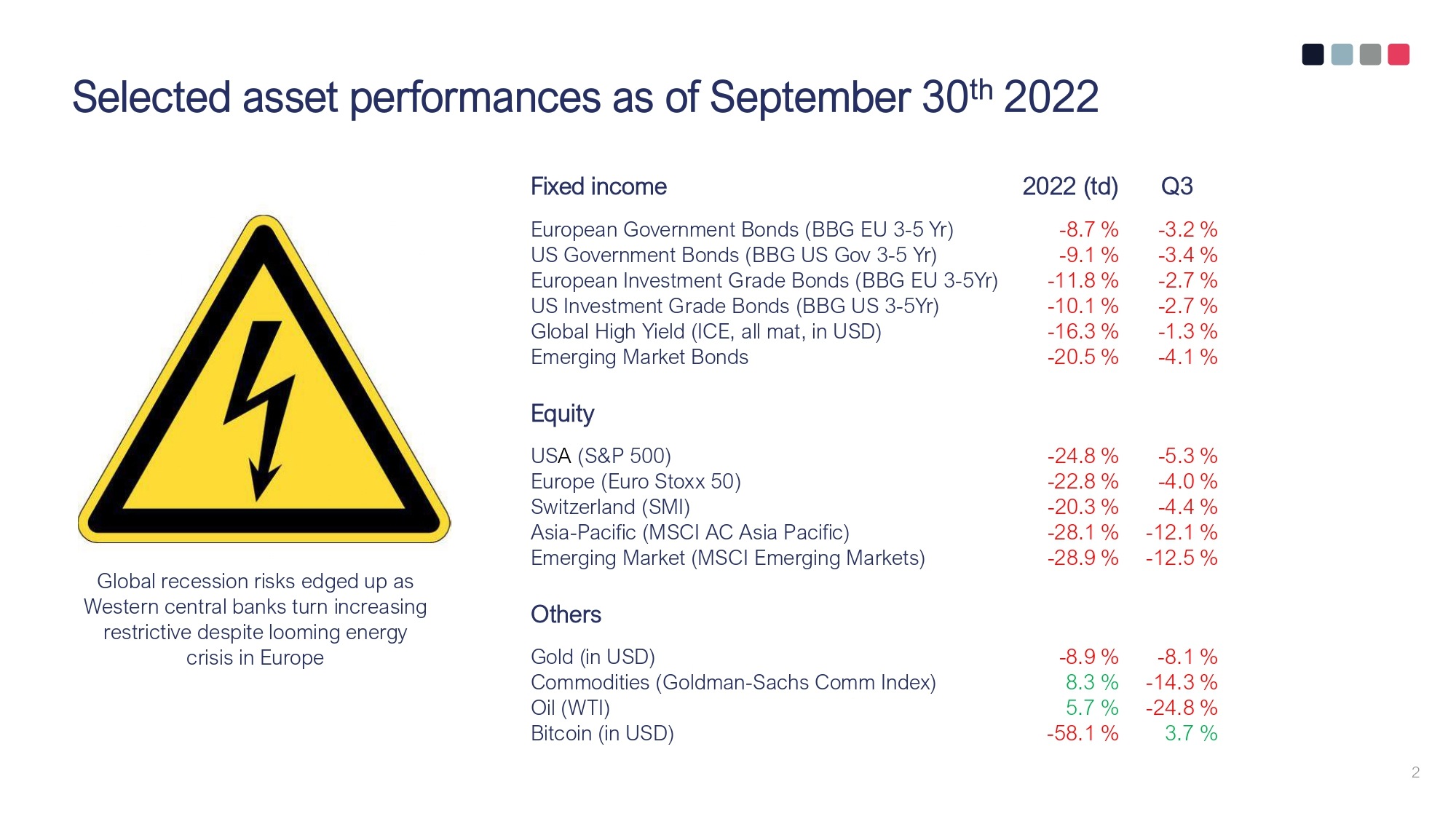

The economic and financial environment deteriorated sharply during the third quarter, as Western central banks turned increasingly tough to restore price stability damaged by soaring energy prices, supply chain deficiencies, unsustainable fiscal largesse and tight labor markets.

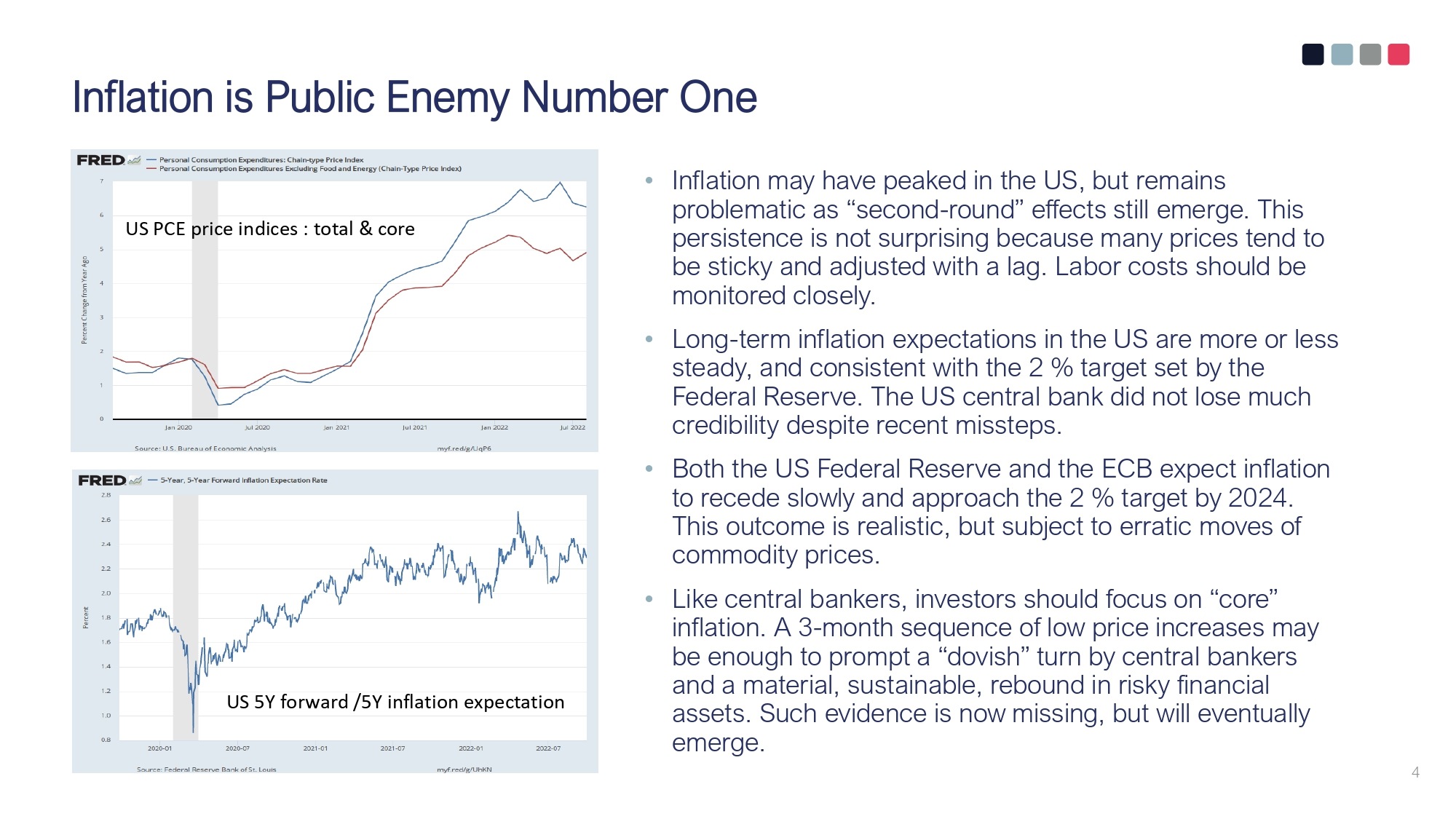

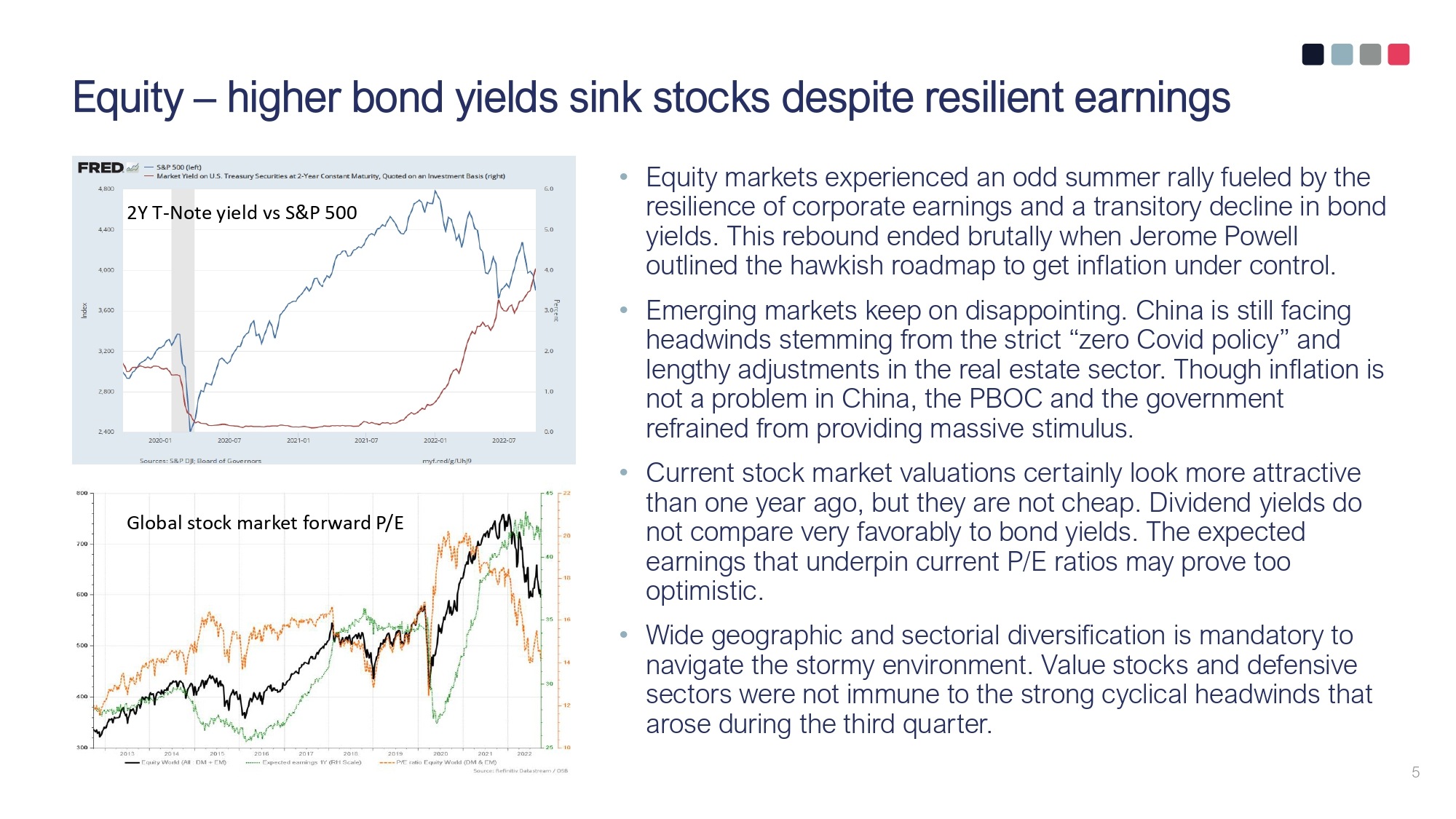

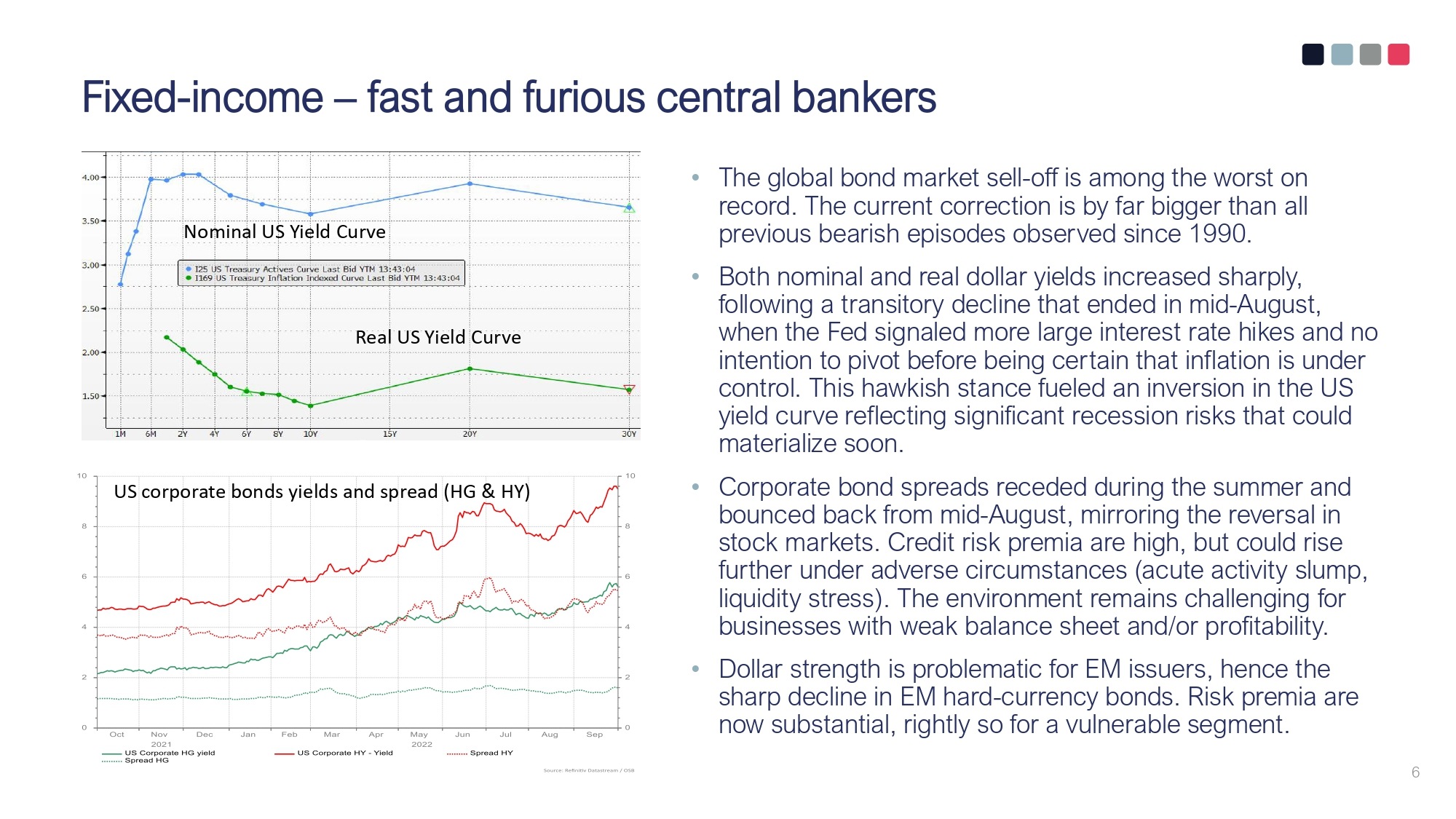

The growth outlook has darkened, as mirrored by recent surveys and ongoing decline in leading indicators. Central bankers expressed an explicit willingness to sacrifice growth, jobs and thus corporate earnings in order to fight inflation. This “hawkish” stance prompted a sharp increase in bond yields with major repercussions for the pricing of all financial assets.

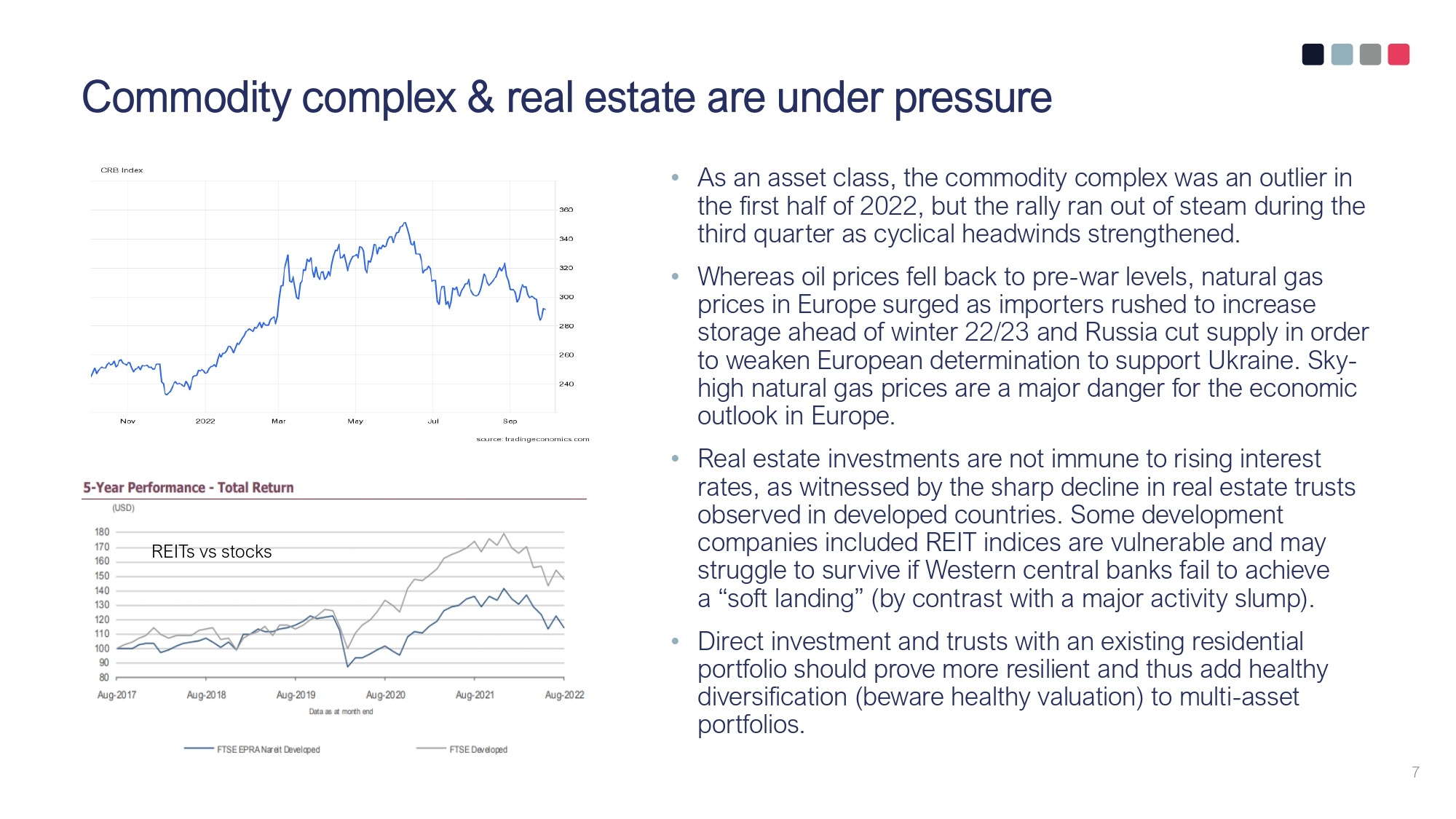

Cyclical headwinds are not expected to abate soon. On the contrary, the fast and substantial increase in interest rates and the energy crisis boiling in Europe will further shrink real earnings and hinder private demand. Falling commodity prices could nevertheless provide some relief.

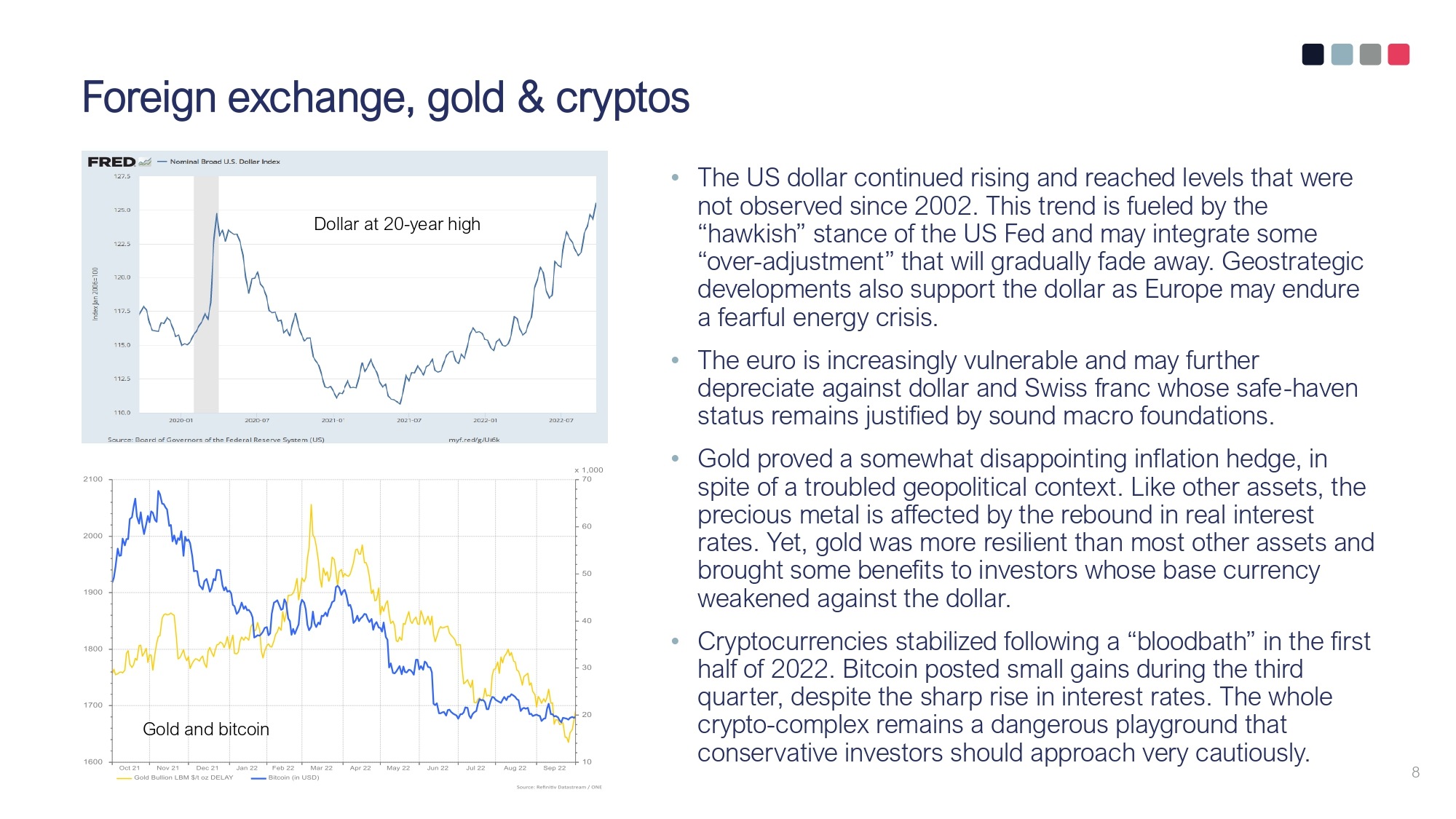

The geopolitical background is worrisome. The globalization process that has fueled low inflation for decades is reversing. The war in Ukraine shed a light on the erosion of the market friendly liberal democratic model that is increasingly challenged by the rest of the world, notably China. Rampant populism and nationalism, also taking root in the US and in Europe, carry serious risks for investors.

It may take time before the tide turns, but the picture is not completely grim. The rise in interest rates is largely priced in by the bond market. Further revision in central banks’ hawkishness cannot be excluded, but a large part of the correction is now history. Compelling signs that inflation is finally receding could prompt a significant rebound in depressed financial assets in a not so far future.