Thanks to prudent management decisions, we were able to minimise the negative impact of the market turmoil and meet our initial expectation for H1 2022, except in terms of AuM.

Ad hoc announcement pursuant to Article 53 of SIX Exchange Regulation Listing Rules

“One year ago, we had completed a promising merger and were finally seeing the light at the end of the pandemic tunnel. Along with this positive outlook, we launched several initiatives to harness new business opportunities. But since early 2022, we have encountered various headwinds – from the surge in new COVID variants, continued worldwide supply-chain disruptions and levels of inflation not seen for decades to the sudden unprecedented rate hikes by central banks (including the SNB’s upward nudge in its negative rate to close to zero) and, last but certainly not least, the Ukraine invasion. Financial markets sharply corrected in the period under review, with shortfalls witnessed in most asset classes. Safe havens were in short supply.

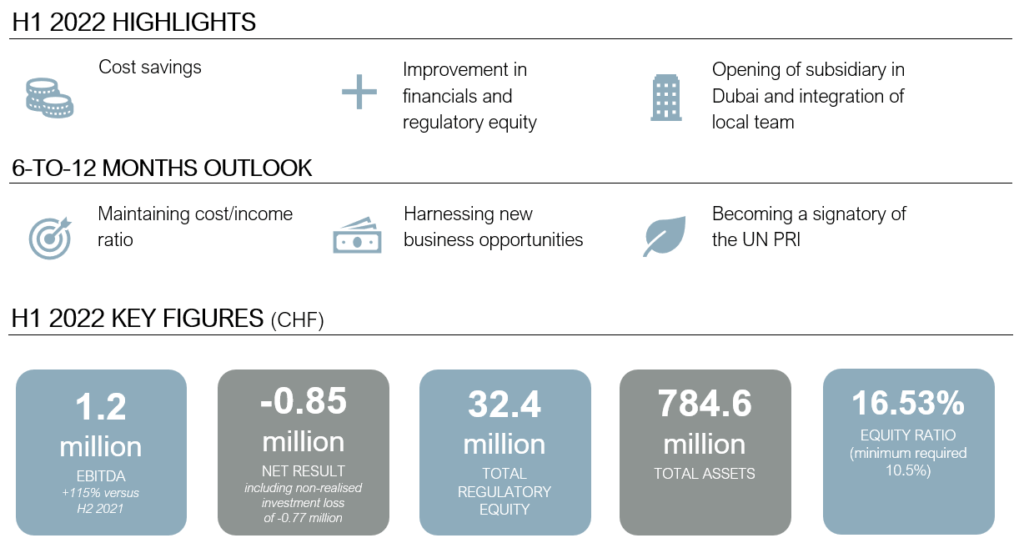

Despite these major complications, we are glad to report that our financial turnaround is on plan and on schedule. Earnings before interest, taxes, depreciation and amortisation (EBITDA) totalled an encouraging CHF 1.2 million in the first six months of 2022, net of an unrealised loss of CHF -771 thousand on our own investments. Excluding this unrealised loss, we would have met our EBITDA target on the strength of a 15% cost saving (relative to the same period in 2021), which lowered the cost/income ratio to 90%. After depreciation and amortisation in excess of CHF 2 million, we ended H1 2022 with a negative net result of CHF -847 thousand (versus CHF -2.78 million in H1 2021). Our Assets under Management (AuM) were impacted by market shortfalls and the strong Swiss franc, leading to a decrease of CHF ‑361 million. The total market performance and forex effect was CHF -437 million. The difference stemmed from Net New Money (NNM), consisting of positive inflows into the Asset Management division. As at 30 June 2021, regulatory equity was CHF 1.7 million higher.

Thanks to prudent management decisions, we were able to minimise the negative impact of the market turmoil and meet our initial expectation for H1 2022, except in terms of AuM. H2 2022 is shaping up as an unpredictable period, and we will continue adhering to a cautious approach to keep costs in check and pursue our strategy of harnessing new business opportunities.”

Grégoire Pennone, CEO, ONE swiss bank

H1 2022 Financial Statements can be downloaded here.

All documents are available on under “Investor relations” section.